|

||||||||

ANNUAL REPORT & ACCOUNTS 2011/2012The CouncilMr. Gehan Kuruppu Mr. Dinesh De Silva Mr. Sean Van Dort HONARARY MEMBERS OBSERVER SECRETARY GENERAL SECRETARIAT MEMBERSHIPThe National Chamber of Commerce of Sri LankaMr. Gehan Kuruppu Mr. Dinesh De Silva Mr. Sean Van Dort Mr. N. Ramanathan Mr. Russel Jurianz Mr. Rohan Daluwatte Mr. Rasa Weerasingham Mr. Linton Santiago Mr. Nalin Silva Mr. Tony De Livera Mr. Ajith Jayasekara Dr. Upali Ranasinghe Mr. Dimithri Perera Mr. Andre Fernando Mr. Shiral Fernando The Sri Lanka Shippers' Council AGM 2010/2011 Standing from Left to right Mr. Lawrence Paiva, (Sri Lanka Association of Air Express Companies) Mr. Niral Kadawatharatchie (Sri Lanka Freight Forwarders' Association), Mr. Tony De Livera (Sri Lanka Freight Forwarders' Association), Mr. Adrian Oswald (The Ceylon Chamber of Commerce – Import Section), Mr. Harith Jayasuriya (Sri Lanka Logistics Provider's' Association), Mr. Russel Juriansz' (The Ceylon Chamber of Commerce), Ms. Diruni Chanmugam (National Chamber of Exporters of Sri Lanka), Mr. N. Ramanathan (The Ceylon Coir Fibre Exporters' Association), Mr. Chandra Corea (The Colombo Tea Traders Association), Mr. Ajith Jayasekera (Sri Lanka Apparel Exporters Association) Seated from Left to RightMs. Irangika Siriwardena (Secretariat), Mr. Randolph Perera (Past Chairman), Mr. Dinesh De Silva (1st Vice Chairman), Mr. Gehan Kuruppu (Chairman), Mr. Ananda Wijesuriya (Past Chairman), Mr. Gordon De Silva (Past Chairman), Mr. Ravi Rathnapala (Past Chairman), Mr. Rasa Weerasingam (National Chamber of Exporters of Sri Lanka), Ms. Manjula Maldeniya (Secretariat) INDIVIDUAL MEMBERSAgility Logistics (Pvt) Ltd SRI LANKA SHIPPERS' COUNCILSri Lanka is a nation depending heavily on shipping services. Historically Colombo has been recognized as the most important and strategic geographical point in the east-west maritime group, which was also named as "Silk Route" The Sri Lanka Shippers' Council was established in March 1966 to protect and promote the interests of shippers. It was the first National Shippers' Council to be set up in Asia and was formed on a request made in 1965 by the local Committee of the Ceylon/Continental Conference, and a subsequent request made by the Director of Commerce in January 1966, to the Ceylon Chamber of Commerce. The Sri Lanka Shippers' Council is the apex body that represents the interest of shippers. Membership of the Council consists of Chambers of Commerce and Trade Associations, and fourteen such organisations are currently members of the Council and the Council represents more than 70% of the import/export trade. The Council derives its broad based representation and membership from these trade Associations. The Council has now opened its doors to individual companies as Associate Members so that companies in the import/export trade could have access to the Council's resources and expertise to resolve their shipping related problems. The Sri Lanka Shippers' Council is headed by an elected Chairman and assisted by two Vice-Chairmen who are also elected by the constituent members. The Ceylon Chamber of Commerce provides secretarial services to the Council and also acts as the Secretariat. The Council actively supports the Sri Lankan Government's vision of making Sri Lanka the Logistics Center in the Asian region, which would result in the generation of enhanced economic activity, employment and wealth. As such all Council activities have been planned and prepared to support this vision and to facilitate International trade The Sri Lanka Shippers' Council is a founder member of the Association of Shippers' Councils of Bangladesh, India, Pakistan and Sri Lanka (ASCOBIPS), founded in 1981 and the Asian Shippers' Council, founded in 2004. OUR VISION"To enhance the competitiveness of our members by abolishing hidden logistics costs." OUR MISSIONWe facilitate our customers to be more competitive in their Business Logistics; performance and cost, by the following;

It is the Council's firm belief that in order to be competitive with the international market Sri Lankan shippers should;

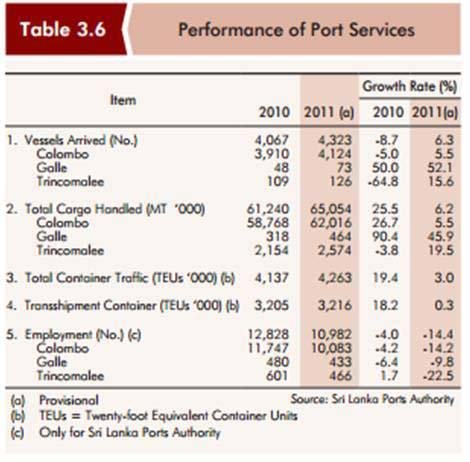

OVERVIEW OF THE ECONOMYEconomic GrowthThe economy grew by 8.3 per cent in 2011, the highest in Sri Lanka's post independence history, sustaining a growth momentum of over 8 per cent for the first time in two consecutive years. Improved consumer and investor confidence arising from the peace dividend, favourable macroeconomic conditions, increased capacity utilisation, expansion of infrastructure facilities and renewed economic activity in the Northern and Eastern provinces underpinned this growth. The Industry and Services sectors were the drivers of the high growth momentum in 2011. The Agriculture sector rebounded from the output loss recorded due to adverse weather conditions during the beginning of the year. The expansion in economic activity was reflected in the unemployment rate, which declined to the lowest recorded level of 4.2 per cent in 2011. Inflation remained at single digit levels for the third consecutive year supported by improved domestic supply conditions, prudent liquidity management by the Central Bank and benign inflation expectations. Annual average inflation was 6.7 per cent while year-on-year inflation was 4.9 per cent in December 2011. Year on- year inflation trended upwards during the first few months of the year due to adverse weather conditions that disrupted domestic food supply. However, the trend reversed from May with the significant recovery in domestic food production and inflation was maintained at mid single digit levels by the end of the year. Low inflation and subdued inflationary expectations allowed the Central Bank to continue to ease monetary policy in January 2011, but cautious and gradual tightening was initiated thereafter as credit and monetary aggregates continued to grow at a rate higher than projected. The external sector, which strengthened in the first half of 2011, came under pressure during the latter part of the year due to adverse global developments and rapid growth in imports. Despite the healthy growth in exports by 22.4 per cent during the year, significantly high import expenditure reflecting high oil prices and a surge in investment and intermediate good imports by 50.7 per cent, led to a rise in the trade deficit to an unprecedented high level. Although improved foreign inflows through private remittances and other inflows to the services account, including earnings from tourism, helped to cover a substantial part of the trade deficit, the current account deficit as a percentage of GDP, increased to 7.8 per cent in 2011 from 2.2 per cent in 2010. Meanwhile, inflows of private long term investments including foreign direct investments (FDIs) and inflows to the government remained healthy. However, as these inflows were not sufficient to offset the deficit in the current account, the balance of payments (BOP) that recorded a surplus by August 2011 turned to a deficit of US dollars 1.1 billion by end 2011. The government continued with its massive infrastructure development drive in 2011, which is fundamental to economic development and plays a crucial role in determining the quality of life. Improving economic infrastructure across the country would lead to the expansion of the production capacity of the economy while increasing economic efficiency and reducing regional disparities, thereby helping to achieve a regionally balanced growth. Development of social infrastructure is also vital for strengthening the human capital base resulting in productivity improvements and innovations which would drive the growth. The government's consistent commitment to improving the economic infrastructure base of the country was evident from various projects being implemented in the areas such as ports, airports, roads, railroads, irrigation, energy and water supply. The first phases of Southern Expressway, Norochcholai Coal Power Plant and the Hambantota Port Project were completed in 2011. The Upper Kotmale Hydro Power Project reached the final stage of completion. In addition, phase II of the Norochcholai Coal Power Plant, Colombo South Harbour Project, Phase II of Hambanthota Port Project, Matthala International Airport, Phase II of Southern Expressway, Colombo – Katunayake Expressway and Colombo Outer Circular Highway were other key infrastructure development projects implemented in 2011. The Services sector contributed 61.8 per cent to the overall economic growth expanding at 8.6 per cent in 2011. The wholesale and retail subsector recorded an impressive growth with improved performance in import and export sectors and healthy growth in domestic trade. The transport and communication sector grew with improved performance in all three sub sectors, namely; transport, cargo handling, port and civil aviation and post and telecommunications. The banking insurance and real estate sector expanded with increased income from both banking and non banking sectors as well as the insurance sector reflecting increased demand for financial services with growing economic activities. Port ServicesA steady growth was seen in the ports sector in 2011. Despite severe set-backs in the pace of global economic recovery, total container handling increased by 3 per cent to 4.3 million twenty foot equivalent container units (TEUs) in 2011 while transshipment handling increased marginally. The total cargo handled increased by 6.2 per cent to 65.1 million metric tons. The total number of vessels arriving at the port of Colombo grew by 5.5 per cent. As per the unaudited provisional financial data, financial performance of the Sri Lanka Ports Authority (SLPA) improved significantly despite the sluggish pace of global trade. The revenue of the SLPA increased by 10.5 per cent to Rs. 31.2 billion, while the operating expenditure decreased by 3.9 per cent to Rs. 30 billion in 2011. The operating profit of the SLPA increased by 89 per cent to Rs. 8.3 billion compared to Rs. 4.4 billion in 2010. Development of port infrastructure has been at the forefront of the government's infrastructure development drive. Construction of Phase I of the Hambanthota Port was completed in December 2011 and full scale commercial operations are expected to commence by mid- 2012. SLPA shortlisted 14 of the 27 Expressions of Interest received for the setting up factories at the Hambantota Port. Four proposals to set up petrochemical, cement, sugar and fertilizer processing plants have been approved by the Cabinet of Ministers. Construction of an oil tank farm with fourteen tanks was in progress at the Hambantota Port to facilitate the supply of bunkering fuel. The Colombo South Port project was in progress in 2011 and construction of the South Container Terminal is expected to commence in early 2012. The estimated project cost is US dollars 500 million and the terminal is expected to commence operations in May 2014 with the capacity to handle another 2.4 million TEUs per annum. All land, building and road construction work of the Oluvil Port was completed in 2011 while the entire project is expected to be completed by July 2012. The project comprises a commercial harbour and a basin for fishing rafts. Upon completion of reconstruction work of the Galle Port,it will cater to the tourism sector in the region by developing a Yacht Marina, which will attract more yachts. The Trincomalee harbour has been identified as a centre to cater for bulk cargo and port related industrial activities including heavy industries, tourism and agriculture. SLPA has also proposed to build a Port City adjacent to the Port of Colombo at an estimated cost of US dollars 700 million. This will consist of a range of facilities such as luxury hotels, apartment complexes and shopping malls. SLPA took measures to improve productivity and efficiency of container and cargo handling to maintain its competitiveness. In the face of the slow growth in the global trade and competition from regional ports, Sri Lanka needs to take timely measures to improve productivity and efficiency in the port sector. With a view to improve productivity, in 2011, both the Jaya Container Terminal (JCT) and South Asia Gateway Terminals Limited (SAGT) have installed new equipment to reduce turnaround time. Further, SLPA recognised the need for capacity building among existing employees to help improve competitiveness of its port operations. The staff was provided with required training to help improve their soft skills, human resource management and technical skills.  Export Performance Exports which rebounded in 2010, strengthened further during 2011 despite a fragile recovery in the world economy. Earnings from exports exceeded the US dollars 10 billion mark and reached US dollars 10,559 million, an increase of 22.4 per cent in 2011 over the previous year. The export growth in 2011 is commendable and highlighted the resilience of exports as it was achieved amidst slow and uncertain economic recovery in Sri Lanka's traditional markets, particularly, USA, EU, and the Middle East. The expansion in domestic economic activities and the favourable investment climate with low interest rates and improved infrastructure contributed to the growth in exports. The largest contribution to the growth in export earnings amounting to US dollars 1,896 million came from industrial exports followed by agricultural exports (US dollars 221 million). Industrial exports increased by 31.1 per cent to US dollars 7,992 million in 2011. Major contribution to this growth came from exports of textiles and garments, rubber products and petroleum products. Further, earnings from exports of food, beverages and tobacco, gems, diamonds and jewellery, transport equipment and machinery and mechanical appliances made a significant contribution to export earnings. Earnings from agricultural exports, which accounted for 23.9 per cent of total exports, increased by 9.6 per cent to US dollars 2,528 million. Earnings from traditional agricultural crops increased due to higher prices that prevailed in the international market during the first half of 2011. Among agricultural exports, tea accounted for 14.1 per cent of total export earnings in 2011 followed by coconut (2.5 per cent), spices (2.2 per cent) and rubber (2 per cent). Tea exports continued to be the major agricultural export, contributing 59 per cent to the total agricultural exports. Earnings from export of rubber and coconut increased mainly due to an increase in prices. A short supply of natural rubber in the world market resulting from unfavorable weather conditions in major rubber producing countries coupled with high oil prices contributed to higher prices at the Colombo auction, particularly in the first half of 2011. A short supply of natural rubber in the world market resulting from unfavourable weather conditions in major rubber producing countries coupled with high oil prices contributed to higher prices at the Colombo auction, particularly in the first half of 2011. Despite higher export prices, export volumes of rubber declined by 17.9 per cent in 2011, due to increased domestic demand by rubber manufacturing industries and the Cess on raw rubber exports. Meanwhile, earnings from export of coconut products increased by 60.4 per cent to US dollars 266 million in 2011, largely due to higher earnings from desiccated coconut exports. The sharp increase in desiccated coconut exports was driven by higher volumes and favourable prices fetched at auctions. Export of fresh coconuts declined both in value and volume terms by 46.4 per cent and 60.5 per cent, respectively, in 2011 due to increased domestic demand. Earnings from spices and minor agricultural products grew with favourable prices in the international market. Earnings from spices led by cinnamon and nutmeg increased by 13.5 per cent to US dollars 235 million in 2011. Cinnamon exports grew by 31.4 per cent to US dollars 129 million largely due to an increase in prices by 30.8 per cent to US dollars 9.38 per kg in 2011. Earnings from pepper and cloves declined due to a decrease in export volumes although prices remained high. Minor agricultural products including fruits, edible nuts, cereals, flowers and foliage and cocoa recorded higher export earnings. Earnings from unmanufactured tobacco increased by 19.2 per cent to US dollars 38 million in 2011. Import PerformanceExpenditure on imports increased by 50.7 per cent to US dollars 20,269 million in 2011 compared to US dollars 13,451 million in 2010. Higher demand for all major categories of imports; consumer, intermediate and investment goods, as well as higher international commodity prices contributed to the surge in import expenditure. Import of intermediate goods accounted for 60.6 per cent of total imports while investment goods accounted for 21.2 per cent of total imports. Consumer goods imports accounted for 18 per cent to the total import expenditure. The average import price of crude oil increased by 36.6 per cent to US dollars 108.59 per barrel during the year, compared to US dollars 79.52 per barrel during 2010, mainly due to increased demand from emerging market economies and political uncertainties which prevailed in oil exporting countries in North Africa and the Middle East. The expenditure on textile imports amounted to US dollars 2,321 million in 2011, reflecting both the increased demand for apparel exports and higher prices of textiles, particularly prevailed in the first half of 2011.On net terms, exports of textiles and garments amounted to US dollars 1,871 million in 2011. The expenditure on fertiliser imports increased, led by higher prices that prevailed in the international market and increased volume of imports as the fertiliser subsidy was extended to cover all crops, effective from May 2011. Expenditure on wheat and maize imports also increased. Import of other categories of intermediate goods, such as chemicals, diamonds and precious metals also increased during the period. Meanwhile, import of gold, which is the main sub-category within the import of diamonds, precious stones and metals, increased due to the removal of import duty on gold in 2010. Import of investment goods recorded a significant increase of 55.4 per cent in 2011 to US dollars 4,286 million led by increase in transport equipment, machinery as well as building materials. Increase in investment goods imports was attributed mainly to the large scale infrastructure development projects of the government funded by foreign inflows, which increased substantially during the year. Expenditure on imports of Machinery and equipment which comprise engineering equipment, electronic equipment, telecommunication devices, office machinery, medical and laboratory equipment and machinery for the textile industry increased. Expenditure on imports of transport equipment which comprise vehicles for transport of passenger and goods, heavy-duty vehicles, small scale ships and also boats and building materials which comprise mainly cement, iron and steel, aluminum articles and mineral products also increased in during year 2011 reflecting an expansion in construction activities in the country. Expenditure on import of consumer goods increased by 47.5 per cent to US dollars 3,654 million in 2011. Non-food consumer goods contributed 57.1 per cent to the total of consumer goods imports. The main contributor to increase the imports of non-food consumer goods was personal motor vehicles, motor cycles and trishaws. Increase in motor vehicle imports was influenced by the reduction in import duties and supported by relatively easy access to credit at competitive rates and increased real income levels. The expenditure on import of Medical and pharmaceutical product, food and beverages, sugar and confectionery goods and Import of dairy products, including milk powder also increased. Direction of TradeIndia remained the major trading partner in 2011 followed by Singapore and USA. The other countries that had trade over US dollars 1 billion in 2011 include China, Iran, UK and Japan. USA and UK remained the largest export destinations, while India and Singapore followed by China remained the foremost import origins in 2011. India contributed to over 16 per cent of Sri Lanka's external trade in 2011. USA accounted for 20.3 per cent of Sri Lanka's exports, followed by UK (10.5 per cent) and EU (23.3 per cent, excluding UK). Garments continued to account for the bulk of exports to these markets. Among EU member countries, Italy (5.8 per cent), Belgium (5.4 per cent) and Germany (4.8 per cent) remained the leading export destinations in 2011. Almost 79 per cent of Sri Lanka's processed diamonds were exported to Belgium in 2011. Exports to India accounted for about 4.9 per cent of Sri Lanka's total exports, increased by 9.5 per cent in 2011 and comprised of machinery and equipment, animal fodder, spices and garments. Russia continued to be the major destination for tea exports accounting for nearly 17 per cent of total tea exports in 2011. Singapore emerged as an important export destination in 2011 by accounting for nearly 3.9 per cent of Sri Lanka's exports. India continued to be the largest source of imports in 2011 and accounted for nearly 21.9 per cent of imports in 2011. Total imports from India amounted to US dollars 4,431 million in 2011. Main imports from India were refined petroleum products, motorcycles and auto-trishaws. Singapore and China followed as the second and third largest import origins, accounting for 10.5 per cent and 10.3 per cent of total imports, respectively. Main imports from Singapore comprised fertiliser and petroleum products, while the major imports from China were machinery and cotton. Iran and Japan remained the fourth and fifth largest source of imports, respectively. Imports from Iran and Japan comprised mainly crude oil and motor vehicles, respectively. (Source: Central Bank Annual Report) OFFICE BEARERSAt the 41st Annual General Meeting held on 29th July 2011, Mr. Gehan Kuruppu was re-elected as the Chairman of the Council for the year 2011/12. Thereafter, Mr. Dinesh De Silva and Mr. Sean Van Dort were re-elected as 1st Vice Chairman and 2nd Vice Chairman of the Council respectively. ACTIVITIES OF THE COUNCILThe activities of the Council have been focused on issues faced by shippers on shipping and their operational activities. The Council always performed a lead role in resolving problems and serve as the focal point where various shipping and port, Air port & other authorities related matters are brought up and discussed. In addition, the Council actively advises the Government on matters relating to port and shipping whenever its advice is sought after. The following ten (10) action committees were appointed for better co-ordination and guidance purposes, :

A detailed description of the activities of the Council appears elsewhere in this report. However, in this section for your easy reference we give below the main topics covered in the report.

TERMINAL HANDLING CHARGES (THC)At the beginning of the year, the Council sent a written request to Dr. P B Jayasundara, Secretary to the treasury stating the various charges levied by Shipping lines and forwarders seeking his assistance to eradicate these unfair charges in the industry. The Sri Lanka Shippers Council in co-operation with the Ceylon Chamber of Commerce convened a meeting for the key stakeholders of the Shipping industry on 15th March 2011 to deliberate the macro issues of concerns and remedial action required to drive the industry. A list of charges prepared by SLSC that had been forwarded to the Secretary to the Treasury was briefly discussed at this meeting. It was suggested that the Shippers Council secretariat should be informed of all the charges levied with specific details so that the overall picture could be ascertained. SLSC developed a template to collate all these adhoc charges and circulated among all the stakeholders in the industry (CASA, SLFFA, SLSC) requesting feedback. The Government Gazette, the licensing of shipping agents, freight forwarders, non-vessel operating common carriers and container operators Act, no 10 of 1972 was published on 02nd August 2011 stating that all freight forwarding companies or a non Vessel Operating Common Carriers should obtain an annual license from Director General's Office of Merchant Shipping (DMS) with effective from 01st January 2012. Consequent to the concerns expressed by the Sri Lanka Shippers Council on ad hoc charges in different forums, Ceylon Chamber of Commerce convened a consultative forum in this regard with the stakeholders of the Shipping industry on 6th September 2011 at Institute for the Development of Commercial Law & Practice (ICLP). Justice Ratnayake made a presentation on liner shipping and "shipping trade" where he focused fully about Ship owners, owning ships, creating employment, ship registration and ship arresting and also on maritime education and shipping law. At this meeting it was suggested to get an independent authority to look at this and to suggest rationalization if required. A committee consisting of Mr. Chandaka Jayasundere and Mr. Chullante Jayasuriya who were more aware and conversant on this matter was appointed to take this project forward. SLSC with a view to resolve the issue collectively convened a separate meeting with stakeholder associations to discuss charges collated in details. In view of the concerns expressed by the committee, SLSC convened a meeting with Director General Merchant Shipping on 2nd October 2011 to discuss further on the gazette & its background & expectations, proposed plan action to regulate the FF's charges. At this meeting SLSC had requested DMS office to build-up database of operating FFs and procedure to record and compile suggestions and complaints regarding the various charges. In the same time, SLSC informed the trade to write to DMS about these ad-hoc charges issues with a copy to SLSC as at the end of the year at the time of renewal of the licences these matters could be further reviewed. In addition, SLSC represented at the 1st meeting of Joint Consultative Committee held on 18 November 2011at the DGMS office to discuss freight Forwarders and NVOCC Licensing regulations, etc. The importance of developing a database for complaints reg. ad hoc charges was also pointed out at this meeting. At the request made by the Executive Committee, Mr. Shantha Weerakoon, former Director General of Merchant Shipping was invited for a Q &A session at the December committee meeting. At the discussion, Mr. Weerakoon had confirmed that according to existing Shipping Act, DMS has no powers to regulate rates but with the upcoming amendment to the existing Act, Minister would have powers to regulate charges levied by FF, NVOCC operators. DMS has requested FFs and NVOCC operators to indicate the present charges when registering with DMS to obtain licenses. In December 2011, SLSC again met with Mr. Malwatte, CCC and Mr. Jayasuriya at the follow up meeting of Stakeholders of the Shipping Industry to discuss further on a template compiled by SLSC expressing justification along with their recommendations on various charges levied by shipping lines/forwarders. Chamber concerned on SLSC's comments which states as "No justification" & "Unacceptable" proposed to reword. Example – "not in line with Inco term" Also proposed for all in rates. Chamber had requested SLSC to re-structure the document based on the above points and submit a proposal to CCC. It was suggested SLSC to take a lead role on this and see as to how this could be resolved. It was also agreed SLSC to request Chamber to continue this discussion with an independent party so that all relevant parties can arrive at some consensus while SLSC would continue to educate the members / Trade as to how this could be addressed commercially. The Council hopes to arrange an awareness sessions in the coming months. FREIGHT RATES & OTHER SURCHARGESFREIGHT RATES:The year under review saw freight rates fluctuating and there was an upward trend compared to the beginning of 2011 towards March 2012. Within the year, it was observed that some liner services were withdrawn due to the low volumes as a result of the global recession. Towards March 2012, the trade had been experiencing indiscriminate increases in freight rates due to General Rate Increase (GRI) imposed by shipping lines. There were several GRI's introduced over the year mainly in the US, Europe and Far East Sector. SLSC observed that further increase would be expected in coming months. It was also noticed that it might come to a situation where lines would reduce their fleet & create artificially manipulated rates. Council's advice is not to pay GRI and it is up to individual companies to negotiate with lines. Within the year it was observed that, certain lines have stopped calling Colombo due to lower rates, by passing, pulled out from normal routing deploying different lines. There was lot of shifting taking place. It was experienced that some lines have offered merged services. It was reported that there was an artificially manipulated capacity shortage created by lines. There is nothing that Shipper's Council can do to reduce rates; market forces will determine the same but trade need to continuously be aware of the situation looking for better options. Towards end 2011, it was reported that crude oil had gone up and the bunkering costs were also increasing. It was stated that on the 15th of April all the lines shipping to Maldives had increased their bunker rates. USA – both Mearsk and MIT increased the bunker rate for exports from US$ 50 – US$120. Over the year 2011, the imports rates saw a decline and had come down and stable. But there was a slight increase in the Indian imports rates. The reason was that heavy weights couldn't be shifted from Chennai and importers should have to pay higher rates. It was reported that when containers come to Delhi it would take at least one week unless pay higher rate. It was also evidence that imports rates have also gone up rapidly due to GRI and increase of fuel charges towards the beginning of March 2012. The same trend would be expected to continue in the future. With regard to the Courier rates, in the beginning of year 2011, the fuel surcharge was 23% but rates have been fluctuated by +/- during the course of the year 2012. The fuel surcharge is linked to the Rotterdam price index FUEL SURCHARGE:The global fuel prices have been fluctuating for the past few years. It is envisaged that these prices will continue to fluctuate in the foreseeable future, as such, most air express companies have introduced a fuel surcharge to defer part of their increased transportation costs. Most companies use the Monthly average spot price of the United States Gulf Coast Kerosene-type Jet fuel to calculate a fuel surcharge and for easy reference you may click USGC Kerosene-type Jet Fuel Spot Price to access the source data. There may however be marginal differences among the rates applied by our members globally due to time lags in implementation and differing cost structures. The applicable fuel surcharge charged by various companies will be notified to customers by their respective service providers. (Source: SLAAEC) ELECTRONIC DATA INTERCHANGE (EDI)Just as mentioned in the previous years, the long awaited E-Customs module, the ASYCUDA World (AW) system has come to a reality during the later part of the year. The Customs has now beginning to implement the AW and there are further areas to be completed. It was started with motor vehicle imports and had moved on to exports. The system at the exports division (CBEX1 office) was implemented in April 2012 where the CUSDECs can be submitted through the DTI system. Sri Lanka Customs has also implemented the electronic manifest facility with the objective of phasing out the hard copies of the manifest. The existing online submission of CUSDECs and Blend Sheets to the Tea Export Section of the Sri Lanka Tea Board (SLTB) and to the Sri Lanka Customs (SLC) developed and converted into AW System. Under the said DTI facility all registered exporters of tea are required to forward all of their CUSDECs with Blend Sheets pertaining to exportation of tea through online under the AW system to the SLTB and SLC. BOI operation through AW is expected to commence in July 2012. SLSC was informed that the Long Room will be shifted to the new building by July 2012 and then would start the online submission of CUSDECs for the air cargo sector as well. SLC is of the view that the AW had a number of features the Asycuda Plus Plus system did not have. The main feature was that the CUSDECS of all communications could be done through the web which was not available with the previous systems. Asycuda World system will be completely successful only when the trade cooperates fully with the Customs by sending their import export documentation electronically. Sri Lanka Customs is delaying moves to go fully online with 20 percent of the trading community are not willing to avail themselves of the online cargo clearance system already in place. SLSC observed that the new system was in place despite minor shortcomings due to network and technical errors and Council is pleased to see that by the end of the year, Sri Lanka Customs would have a very successful automation system for all importers and exporters. SRI LANKA CUSTOMSThe Council is pleased to announce that the dialogues with the Sri Lanka Customs continued, along with the other Association, during the year under review. Concerns of the Importers and Exporters with regard to various policy matters and operational issues were brought to the attention of the DG Customs during this period. Issues related to the trade were discussed including issues from Apparel sector. Main points were delays in export updates for VAT refunds, imposing of penalties by customs, implementation of ASYCUDA world fully, structure on customs OT charges, customs resources at SLPA warehouses & gates. Also it was pointed out that different facilities are available in different BOI Zones and customs OT charges are of a complicated nature. It was also said that especially on the apparel sector, forwarders do lot of customs activities & there are lapses and it was stressed that exporters / importers should directly approach the relevant head DC and then the ADGC before reporting / discussing at the DGC level. SRI LANKA PORTS AUTHORITYDuring the course of 2011, SLSC has had very productive round table discussions with the Chairman and other top Directors of SLPA to discuss various issues pertaining to the industry. Some of the issues highlighted were;

Shippers' Council also submitted a submission for an interactive discussion with SLPA organised by CCC as a follow up activities of Approved Associations Meeting. At this meeting, Shippers' Council took a lead role in addressing the issues raised by the members of Approved Associations. At these meetings, SLPA Chairman informed the trade,

SLSC is pleased with the infrastructure development projects and port expansion projects taking place at the SLPA to ease the import export procedure. SLPA CARGO MANAGEMENT MODULESri Lanka Ports Authority last year installed an online system to clear cargo which was expected to centralize the port, yards and Customs for faster clearance reducing many hassles faced by clearing agents. Further, SLPA introduced the cargo management Module in the beginning of year 2012 which would benefit all the clients who work with the port to reduce paper work and expedite the process when doing business with the port. All documentation for export cargo will be handled only through this newly implemented cargo module from 02nd May 2012. THE ASIAN SHIPPERS' COUNCIL (ASC) & GLOBAL SHIPPERS' FORUM (GSF)The Asian Shippers' Council Annual meeting & Global Shippers' Forum Annual meeting was hosted in Atlanta, Georgia last year from 13-17 November 2011. The decision to incorporate the GSF at the Annual Meeting in Macau in September 2010 resulted in an invitation to jointly establish a new global alliance of air cargo global representative body in conjunction with IATA (International Air Transport Association), TIACA (The International Air Cargo Association) and FIATA (International Federation of Freight Forwarders Associations). The motivation behind establishing the Global Air Cargo Advisory Group (GACAG) is to leverage greater collective influence on global air transport regulators, including ICAO and the World Customs Organization (WCO). There were no representations made from the Shippers' Council. SLSC has sent a written communiqué to be announced at the meeting. The next GSF Annual meeting is scheduled to be held on 22-23 October 2012 in London. FEDERATION OF ASEAN SHIPPERS' COUNCILS (FASC)There were no significant activities under FASC after the AGM held in New Delhi 2008. EDUCATION & SEMINARSThere were several productive seminars conducted by SLSC during the year under review. The topics and a brief description of the seminars conducted are as follows; Exporters' Forum with Industry leaders (8th September 2011)  Industry Leaders participated from SL Ports Authority & SL Customs at the Forum Shippers' Council conducted a field visit to Colombo South Harbor Expansion Project (23rd November 2011)  SLSC's members at the construction Site Members of Shippers' Council visited the Colombo South harbour Development Project in order to familiarize themselves with the layout and the project work. A presentation made by Mr. K.M.T.B. Ganegoda, Project Engineer of the site provided a glimpse of the entire project for the benefit of the participants. Prior to the visit, a group of Council's representatives met with Dr. Priyath Wickrama, Chairman Sri Lanka Ports Authority together with other key officials.  Joint Meeting with stakeholders and Government Authorities– Issues of Methyl Bromide (Me Br) Fumigation Treatment (31st January & 28th February 2012) Consequent upon Sri Lanka being a signatory to the Montreal Protocol on the usage of Pesticides and Ozone depleting Substances (ODS), new regulations have beenenforcedby the Registrar of Pesticides (ROP) in relation to the usage of Methyl Bromide (Me Br) for fumigation of containers for export. As per the Montreal protocol guidelines, at present, Me Br is allowed only for quarantine and pre shipment (QPS) operation. According to these regulations, all fumigation undertaken using Me Br will have to be carried out under the supervision of officers of Plant Quarantine Department. Cargo so treated will need to be kept for a period of 24/48hrs as determined by the authorities. No authorization letter will be issued to purchase MB unless the authorized officer of NPQS has signed RP8 form (Me Br declaration form). In response to a request made by the treatment providers, Shippers Council immediately convened a meeting with representatives from Exporters, Shippers and Me Brtreatment providers on 31st January 2012 to discuss the difficulties/concerns reg. the regulations issued by ROP. As suggested at the meeting, a subsequent meetingwasarranged with relevant key officials from Seed Certificate and Plant Protection Centre (SCPPC), National Plant Quarantine Services, Ministry of Agriculture Registrar of Pesticides (ROP), National Ozone Unit, Ministry of Environment. At this meeting, it was agreed to change / ease the process and the participants had requested to issue a directive stating the changes. As a result of this, the directive No: NPQS/Treatment Technology Division/2012/01 was issued by DD, NPQS in which the overall responsibility of coordinating the monitoring of Me Br fumigation has been entrusted to DD, NPQS, by Director /SCPPC letter no: SCPPC/AFAS/TECH 2012 dated 03.02.2012. Awareness seminar - Extension of the NAVIS' system (26th January 2012) Sri Lanka Ports Authority has announced advance facilities to the shipping industry through further automation. In this context, the Cargo Management Module for exports was implemented on 02nd May 2012 as a part of its automation process. In keeping line with this, the Sri Lanka Shippers' Council organized an awareness seminar on extension of the NAVIS' system, together with Sri Lanka Ports Authority and Bank of Ceylon to educate the industry on; warehouse and yard cargo management with minimum involvement of documentary work, online facilities for service request, invoicing and payments, online facilities for gate functions, seamless connectivity with Terminal Operating Computer System for data interchange.

Sri Lanka Shippers' Council has committed to support this initiative by SLPA and drive this project forward to take the industry to the next level. In view of the above, the following activities were carried out to facilitate the trade; Pilot/Test Run Shippers Council initiated few pilot runs to test the system with some selected port users from the industry before going on line. Council has had several discussions with SLPA team and suggested further improvements needed to the system. Financial Transfer - Discussion with Sri lanka Bank Association (SLBA) members (13th March 2012) Having recognized the need of the payment gateways of SLPA online system to be opened to other banks, the Council organised a joint meeting with member banks of Sri Lanka Bank Association (SLBA) and SL Ports Authority (SLPA) to get their suggestions/views to further improvement of SLPA online payment system. In this context, Shippers Council hopes to submit a proposal to SLPA through Sri Lanka Bank Association suggesting as to how this facility to be extended for other banks enabling all banks to accept payments on behalf the SLPA. Awareness seminar on SIMPLIFIED VAT SCHEME (S-VAT) (29th March 2012) In view of the vital role played by the Export and Import Sector in the country in achieving strong economic growth, Sri Lanka Shippers' Council has organised the above mentioned seminar in collaboration with Sri Lanka Inland Revenue Department (IRD) to create higher awareness among the stakeholders in the industry. Ms. Deepani Herath, Deputy Commissioner, SVAT together with other key officials of IRD made a detailed and informative presentation on the following on S-VAT Scheme;

The participants had an opportunity to to clear all problematic and unclear areas of S-VAT scheme after implementation at the Q & A session handled by Mr. J.P.D.R. Jayasekera, Commissioner, SVAT and Mr. T M Samarasinghe, Assessor of IRD.

Joint Forum: SL Ports Authority & SL Customs (31st March 2012) The Ceylon Chamber of Commerce organised a joint forum with SLPA & SL Customs to clarify some of the recurring issues faced by the industry. The discussion enabled participants to take up issues and make suggestions to Dr. Priyath B. Wickrama, Chairman of SLPA and Dr. Neville Goonawardena, Director General of Sri Lanka Customs. Shippers' Council made a representation and brought up certain issues and obtained clarifications. TRADE COMPLAINTSThe Council continues to facilitate the trade by assisting in the mediation of trade disputes among the shipping lines, freight forwarders, NVOCC Operators, and shippers. REPRESENTATIONSThe Council continues to maintain its close association with the Government and Private sector organizations and also with the Trade Associations with a view to have a continues improvement on the required service levels. Some highlighted direct representations made during the year were as follows;

THE CEYLON CHAMBER OF COMMERCE (CCC)The Chairman of the Sri Lanka Shippers' Council is a member of the Committee of the Ceylon Chamber of Commerce, the oldest Chamber in Sri Lanka with a history of over 170 years. The Council members have had several meetings with the Chamber officials on policy matters relating to port and shipping. MEMBERSHIPThe membership of the Council is open to all Trade Chambers and Associations engaged in Shipping and Port related activities as well as individual companies in the import/export trade. The membership committee is responsible for developing and increasing the membership of the Council. The annual membership fee for Trade Associations/Chambers is Rs. 10,000, while the membership fee for individual companies is Rs. 5,000. FINANCEThe Ceylon Chamber of Commerce manages the Council funds on behalf of the Council. WEB SITEThe website is regularly updated with trade related information and hosts value added services. The new website address of the Council is www.shipperscouncil.lk SECRETARIATThe Ceylon Chamber of Commerce provides Secretarial services to the Council. The infrastructure of the Chamber is readily available to the Council. Sgd Manori Dissanayaka For Secretary THE SLSC SECRETARIAT

SRI LANKA SHIPPERS' COUNCIL |

||||||||

| Solution by Nidro IT Solutions | All rights Reserved. Sri Lanka Shippers Council |